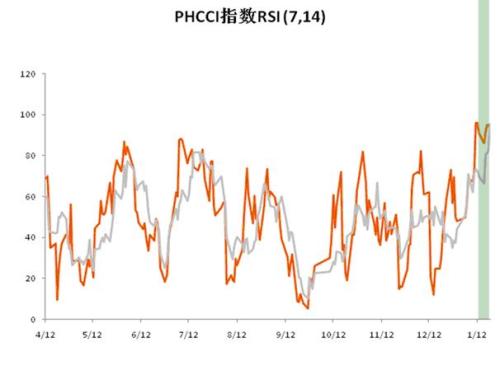

Dongguan Fangbei Electronic Co.,Ltd , https://www.connectorfb.com This week, the Beijing University HSBC China Commodity Futures Index (PHCCI) surged and opened on Monday, 1968.59, closing at 1986.694, up 0.11%. Commodities continued to rise in the middle of the week. As of Friday, the Beijing University HSBC China Commodity Futures Index (PHCCI) closed at 2039.611, up 2.93% from 1981.513 on Friday.

This week, the Beijing University HSBC China Commodity Futures Index (PHCCI) surged and opened on Monday, 1968.59, closing at 1986.694, up 0.11%. Commodities continued to rise in the middle of the week. As of Friday, the Beijing University HSBC China Commodity Futures Index (PHCCI) closed at 2039.611, up 2.93% from 1981.513 on Friday.

Analysis of transactions This week, the domestic futures market was broadly red, and all three sectors showed rising trends. Among them, metal and chemical industry saw the largest increase, which was 3.88% and 2.85% respectively. Judging from the recently released economic data, the U.S. economy recovers, the Chinese economy maintains a relatively high growth rate, and the euro zone economy is relatively sluggish. However, investor worries about the economy have significantly eased. Shanghai copper opened higher and higher this Thursday, closing up 1110 yuan. Copper continued its strong overnight, closing at 8387 US dollars, up 129 US dollars. Due to the strong performance of the US economic data and the easing of concerns about the euro, gold's investment enthusiasm was weighed down. The New York gold February contract was quoted at 1654.5 US dollars per ounce, down 5.4 US dollars per ounce from the previous trading day. The recovery of the US economy and the tense situation in Iran and the West may lead to the interruption of crude oil supply, and the crude oil market has been boosted.

Shanghai aluminum: Shanghai aluminum main contract 1204 this week is also in a high position of shock. It opened at 16165 on Monday and closed at 16395 on Friday, with a weekly gain of 1.42%. Internationally, with the improvement of the euro crisis, overnight LME aluminum rose with the overnight LME copper, boosted by the external disk, domestic aluminum prices also showed a trend of growth. In addition, BHP Billiton has reduced the production of aluminum in South Africa due to power shortages, and the reduction in supply has boosted aluminum prices. On the domestic front, favorable policies for the 12th Five-Year Plan will affect demand for aluminum, which will increase the supply. Therefore, aluminum prices are currently at a high level.

Rebar: This week the rebar main 1205 Monday opened at 4210, closing at 4323 on Friday, or 2.684%. Affected by the increase in LME market data, market confidence has increased significantly. On the domestic front, due to favorable economic conditions, the number of homes and other basic buildings will increase, which will stimulate demand for rebar and boost rebar prices. At the same time, the electricity restriction policy has reduced the production of rebar and further supported prices.

Shanghai Gold: This week, the Shanghai gold main force 1206 has risen for five consecutive days. It opened at 334.18 points on Monday and closed at 339.57 points, or 1.613%, on Friday. Domestic consumers bought a large amount of gold before the Lunar New Year and pushed up the price of gold, causing a continuous rise in the past two weeks. On the international front, the United States initially asked for unemployed 352,000 last week, which was lower than expected. As the leading indicator climbed during the week and the trend of the US dollar became stronger, the current price of gold did not show weakness due to lack of strong trend, and it appeared to be detached from the trend of the US dollar, but it should not be considered The price of gold has detached from the fluctuation of the dollar. Therefore, in the context of the long-term strength of the U.S. dollar, it is not appropriate to overestimate the long-term prospects for gold.